My paycheck tax calculator

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycors Full Suite Of HR Solutions Modernizes How Organizations Manage Their People.

. Your average tax rate is. Massachusetts Income Tax Calculator 2021. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Well do the math for youall you need to do is enter the. It can also be used to help fill.

Heres a step-by-step guide to walk you through. That means that your net pay will be 43041 per year or 3587 per month. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Your average tax rate is. This number is the gross pay per pay period. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Your average tax rate is 1198 and your. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

You need to do these. See your tax refund estimate. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. Enter your info to. Ad Compare 5 Best Payroll Services Find the Best Rates.

Estimate your federal income tax withholding. Starting in 2022 there is no state income tax on the first 5000 of taxable income in Mississippi. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Thats only from standard. Make Your Payroll Effortless and Focus on What really Matters.

New York Paycheck Calculator - SmartAsset SmartAssets New York paycheck calculator shows your hourly and salary income after federal state and local taxes. 21 Sep 2022 0152 PM IST Navneet Dubey. Federal tax withholding calculations.

Well calculate the difference on what you owe and what youve paid. IR-2019- 107 IRS continues campaign to encourage taxpayers to do a. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. As per the Income Tax Act 1961 the interest earned on fixed deposits is added to the income from other sources and is. These are levied not only in the income of residents.

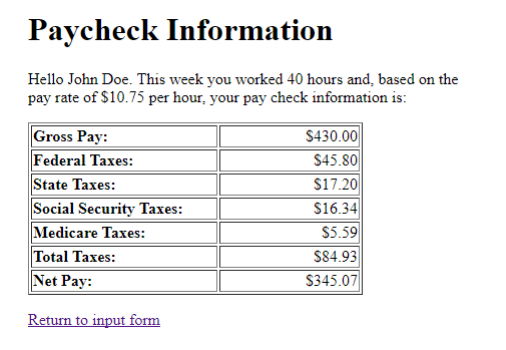

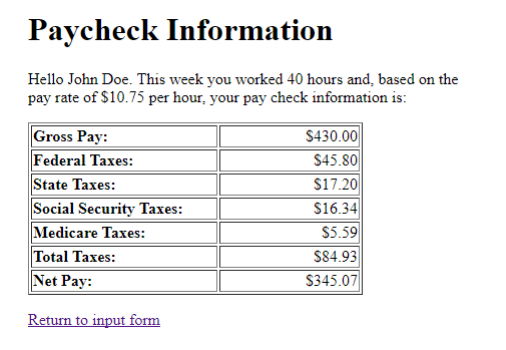

How It Works. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. Ad See Why 40000 Organizations Trust Paycor.

Take A Guided Tour Today. The average Walmart salary ranges from approximately 57806 per year for a Cashier Associate to 278615 per year for a Senior Director Finance. 18 hours agoThe refunds are not taxable as income at the state level.

However a flat rate of 5 applies to taxable income over 10000 according to. 2022 Federal income tax withholding calculation. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Enter your info to see your. See how your refund take-home pay or tax due are affected by withholding amount.

Use this tool to. All tax refunds including the 62F refunds are taxable at the federal level only to the extent that an individual claimed. That means that your net pay will be 40568 per year or 3381 per month.

Total annual income Tax liability All deductions Withholdings Your annual paycheck Thats the five steps to go through to work your paycheck.

Check Your Paycheck News Congressman Daniel Webster

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Solved Paycheck Calculator In This Assignment You Need To Chegg Com

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Income Tax

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Paycheck Calculator Apo Bookkeeping

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Free Paycheck Calculator Hourly Salary Usa Dremployee